When cancelling her AT&T account, a woman noticed that the company charged her a $600 cancellation fee. She thought the fee was excessive, so she filed a class action suit in court, but she didn’t realize she had signed a contract containing a forced arbitration clause. Her case was thrown out, and the woman was forced to pay the $600 dollar penalty – all because of a small clause that is causing legal problems all across the country.

When cancelling her AT&T account, a woman noticed that the company charged her a $600 cancellation fee. She thought the fee was excessive, so she filed a class action suit in court, but she didn’t realize she had signed a contract containing a forced arbitration clause. Her case was thrown out, and the woman was forced to pay the $600 dollar penalty – all because of a small clause that is causing legal problems all across the country.

What Is Forced Arbitration?

Many large corporations have been stung by class action suits and are looking for ways to stop these suits from happening. One tactic they have devised is a method called forced arbitration. This method forces consumers who have grievances with a company to enter into individual arbitration rather than filing a lawsuit. These companies hide the forced arbitration clause in consumer contracts, and are meant to prevent frivolous lawsuits, but experts have found that they actually do the opposite.

The Problem With Forced Arbitration

The New York Times found that corporations that used forced arbitration clauses were able to select arbitrators and the rules of evidence in most cases. This unfairly stacks the odds against any consumer who files a grievance against a company. These clauses also prevent wronged consumers from banding together in class actions suits, which is often the only way they can afford a case against a corporation with almost endless resources. Judges dismissed four out of five civil cases when a forced arbitration clause was involved, and most of the people who filed those suits never went into arbitration because the cost was too high.

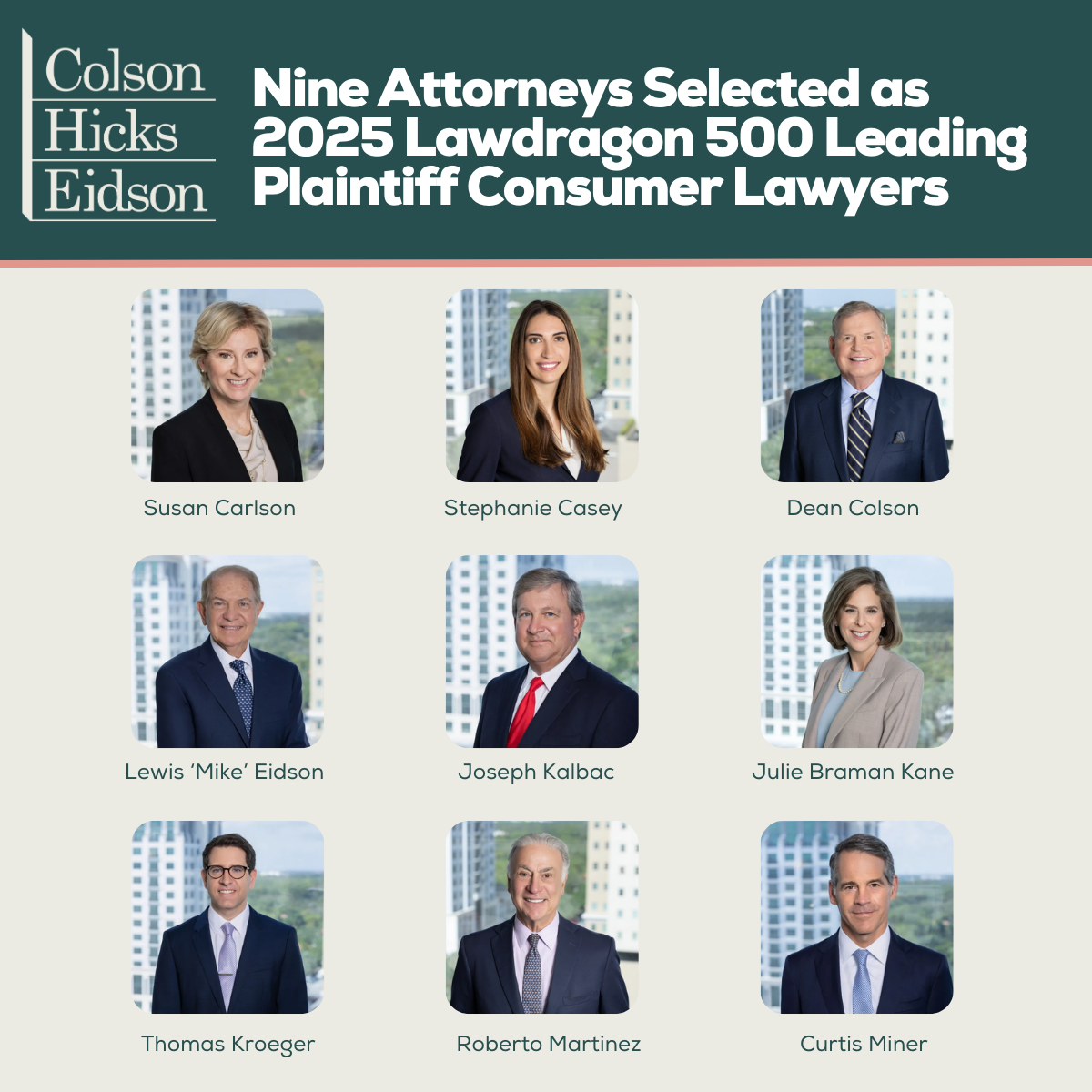

“You run the risk—if you lose—of being assessed the fees and costs and expert expenses of the other side,” Colson Hicks Eidson partner Julie Braman Kane explains. “It is an absolutely rigged forum set up to allow corporations to take advantage of consumers.”