MIAMI (March 6, 2025) – This Women’s History Month, Colson Hicks Eidson congratulates partners Julie Braman Kane and Stephanie Casey who were named Florida Trend Legal Elite NOTABLE: Women Leaders in Law for their significant contributions and leadership in the legal profession.

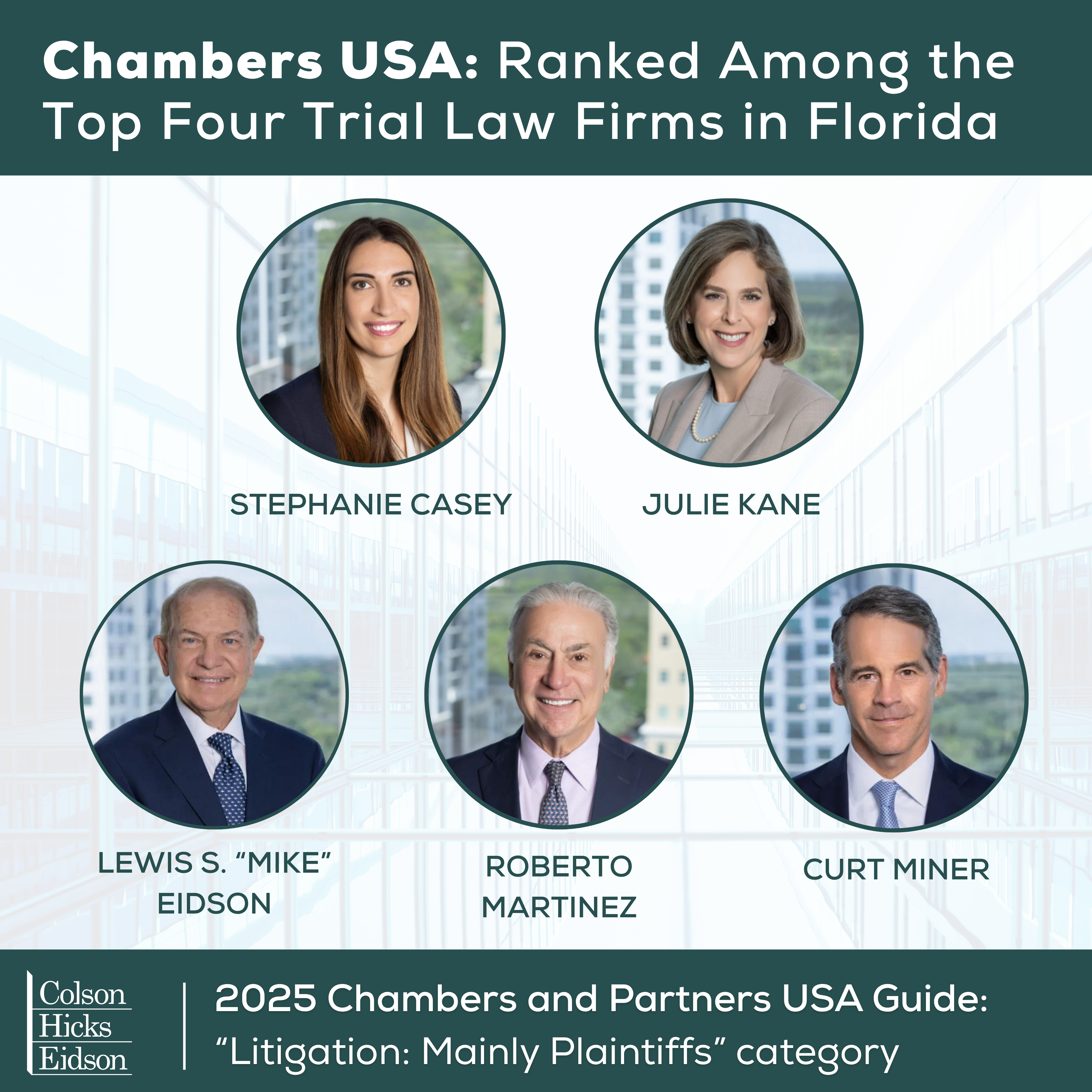

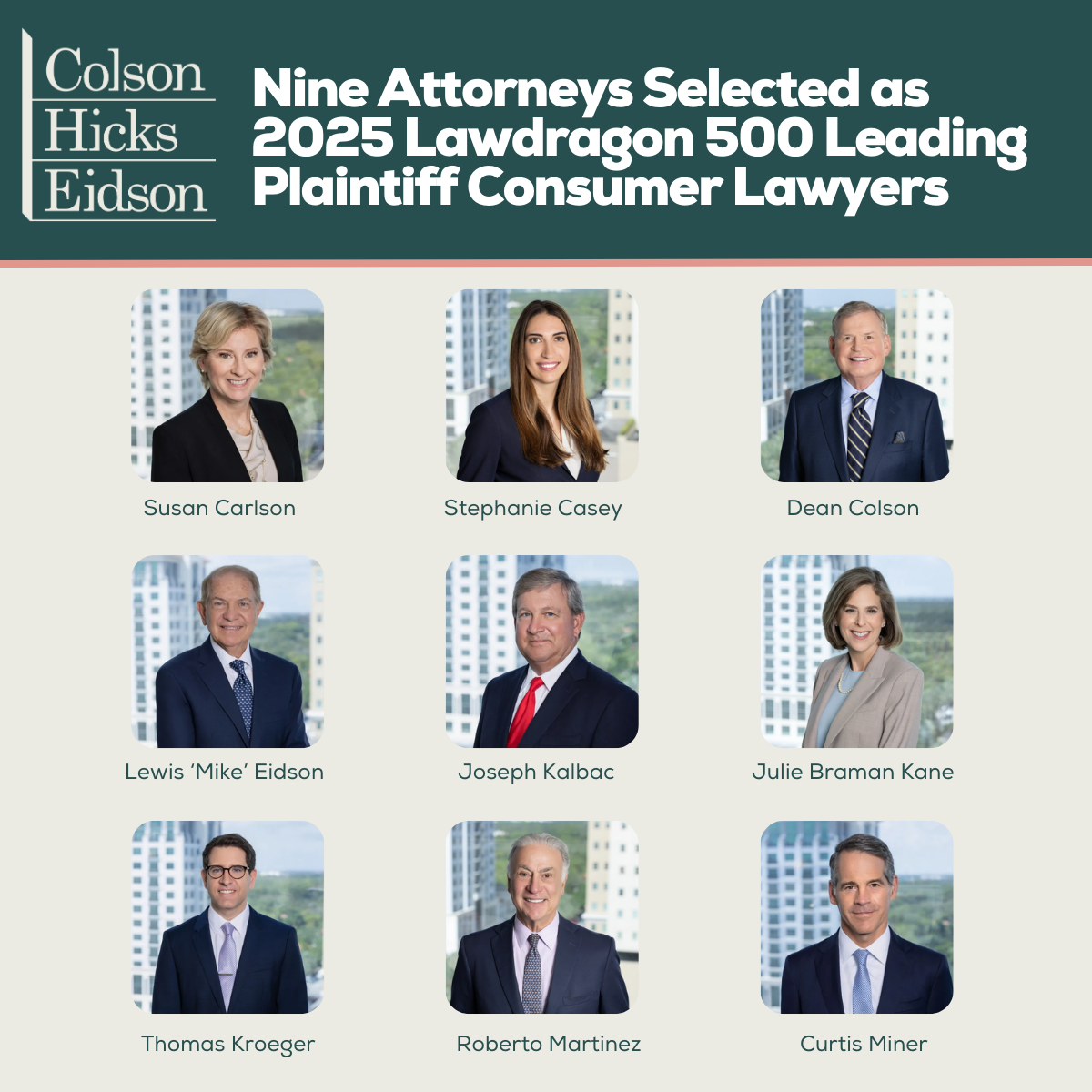

Stephanie was recognized for her representation of injured consumers and her skills in complex litigation, including recent successes in ERISA health insurance benefits cases. Acknowledged by Chambers USA as “an excellent lawyer,” she actively contributes to the legal community as a Board member and former President of the South Florida Chapter of the Federal Bar Association, reflecting her commitment to mentorship and leadership in the profession.

Julie was recognized for her representation of plaintiffs in high-stakes personal injury and complex class action cases, leveraging over three decades of experience. Her accomplishments include serving as lead and liaison counsel in significant multidistrict and consolidated national litigation and securing notable verdicts and settlements in products liability, medical malpractice and negligence cases. A strong advocate for the underrepresented, she has spearheaded efforts to safeguard electoral access and has held leadership roles in the American Association for Justice and the Miami-Dade Florida Association of Women Lawyers. Julie’s legal knowledge is further acknowledged by Lawdragon and Chambers USA, underscoring her significant impact on the profession and her commitment to advancing justice.

We are proud to celebrate Julie and Stephanie, whose recognition reflects their outstanding achievements and the firm’s exceptional success in securing significant judgments and settlements across various areas of law.

Read more: http://digital.floridatrend.com/december-2024/page-86

To schedule a consultation, do not hesitate to contact an attorney at our law office. We have experience in a wide variety of cases for clients located throughout the nation and around the globe.

About Colson Hicks Eidson

Colson Hicks Eidson is a renowned law firm based in Miami, Florida, that is recognized as one of the top trial firms in the United States. Built on a foundation of over 50 years of dedication forging strong client relationships, Colson Hicks Eidson handles local, national, and international litigation, with cases spanning from Miami, Florida, and throughout the United States, to matters in the Caribbean, Central America, South America, and Europe. Learn more at: www.colson.com.